10-K Amendments

By Monte Singh, Partner, Assurance Services & John Maleganos, Staff, Assurance Services

Annually, the SEC reviews 10-K filings and issues comments to filers when necessary. The outcome of an SEC comment letter can vary considerably. The comment may result in no action taken by the company if, subsequent to receipt of the comment letter, the company satisfactorily resolves all SEC questions. However, the SEC comment letter may result in the company filing an amendment to correct its previously issued Form 10-K.

Users of 10-K reports, whether shareholders, employees, the media, and/or other stakeholders, are the beneficiaries of the annual report, which is meant to provide an accurate depiction of a company, free of material error. The aforementioned users are meant to be protected from accounting errors and fraudulent practices, which was the main goal of the Sarbanes-Oxley Act of 2002. The users of the financial information rely heavily on the accuracy of the issued 10-K; however, if a company does have to amend one of its previously issued 10-K filings, shareholders and the general public may be reluctant to trust the accounting and corporate disclosures set forth in the annual report.

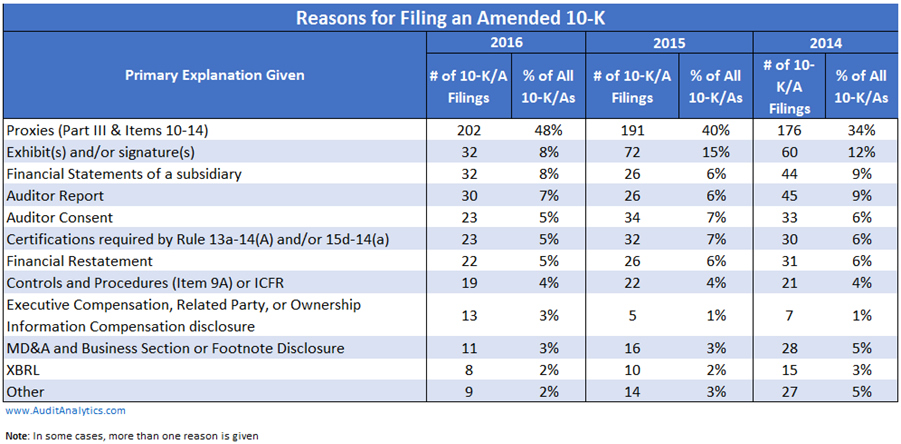

A company may need to amend and refile one of its previously issued 10-K reports for a vast majority of reasons, including but not limited to: proxies, exhibits and/or signatures, financial restatement, and internal controls over financial reporting. Below is a year-over-year comparative analysis (2016 vs. 2015 vs. 2014) for companies listed on the NYSE or NASDAQ that have filed amended 10-Ks.

For the year ended December 31, 2016, there were approximately 420 amended 10-Ks filed, a decrease of 11% as compared to the prior year. For the year ended December 31, 2015, there were approximately 480 amended 10-Ks filed, a decrease of 8% as compared to the prior year ended December 31, 2014, in which there were approximately 520 amended 10-Ks. Of the 4,000 companies analyzed by data and research firm Audit Analytics, approximately 10%, 12% and 13% had to file an amended Form 10-K in 2016, 2015 and 2014, respectively. The percentage, year-over-year, of companies filing amended 10-Ks may seem staggering to users; however, financial restatement contributes to well less than 10% of all amended 10-K filings, and the number of amended 10-Ks as a percentage of total 10-Ks filed is trending downward.

The top three reasons why companies file amended 10-Ks are proxies, exhibits and/or signatures, and financial statements of a subsidiary, which contribute to greater than 50% of all companies’ amended 10-Ks.

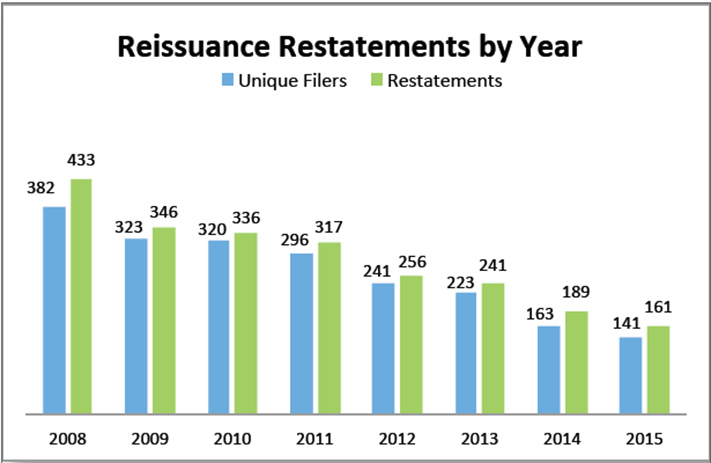

Reissue restatements, defined by Audit Analytics as a restatement that requires the company to reissue the financial statements, have been trending downward every year since 2008 (see chart below. Source: www.AuditAnalytics.com). This is an encouraging finding as this type of restatement is disclosed in an 8-K, Item 4.02, due to the fact that the previously issued financial statement can no longer be relied upon. It is imperative that companies continue to file fewer amended 10-Ks annually, most specifically those that are a result of financial restatement, to increase user satisfaction of the annual report. The reliance on the financial statements underpins the confidence in the markets and when that confidence diminishes, there can be a significant value deterioration.