Changes in the PCAOB Opinion Letter

By Matthew Weiler, Senior Manager, Assurance Services

On June 1, 2017, the Public Company Accounting Oversight Board (“PCAOB”) adopted a new auditor reporting standard, AS 3101, provisions of which will take effect on various dates beginning in December 2017. The changes result in a number of significant modifications to the auditor’s report issued for audit engagements under PCAOB standards. The purpose of the revised standard is to provide additional information about substantive matters in the audit report and to make the auditor’s report more informative and relevant to investors and other financial statement users.

During an audit, auditors often encounter challenging, subjective, or complex judgments which are not communicated in the auditor’s report under the current standard. As a result, there have been calls from the PCAOB’s Investor Advisory Group (“IAG”) for additional communication about such judgments in the standard auditor’s report. Under the new standard, communicated matters will include areas identified by the audit team as matters in which investors would have particular interest, such as management estimates and judgments, areas of high financial statement and audit risk, significant unusual transactions, and other significant changes in the financial statements. The PCAOB believes that such communication will appropriately address concerns raised by the IAG and other commenters.

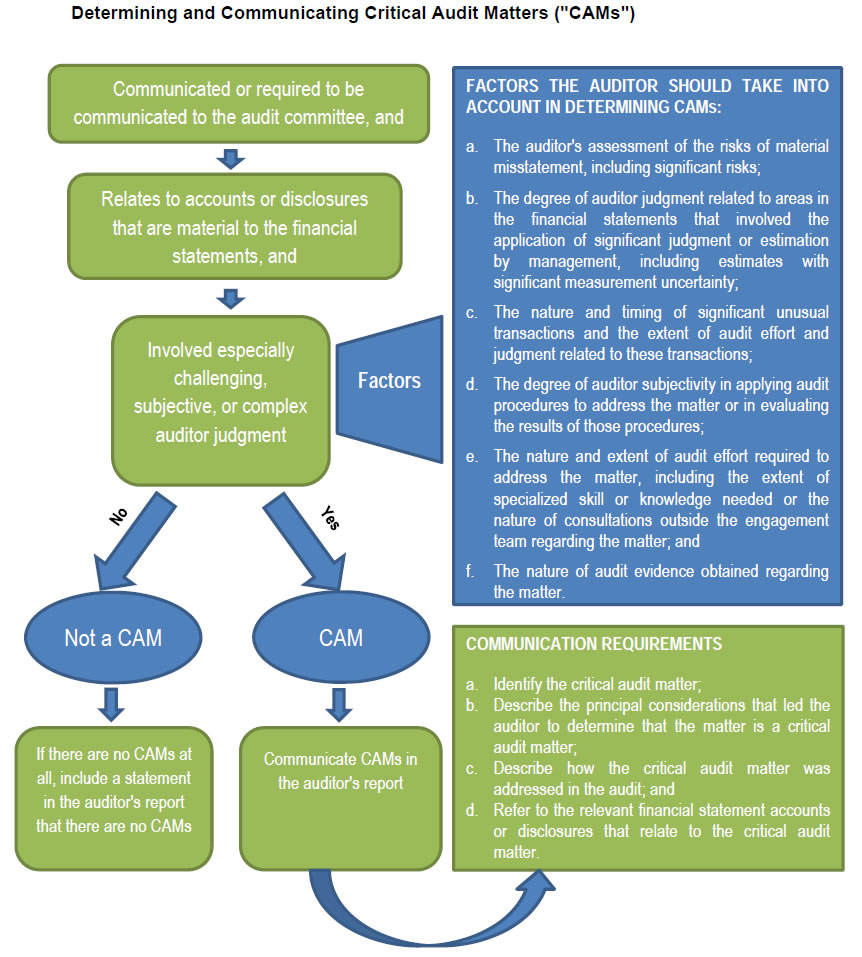

The PCAOB has defined a critical audit matter as ”a matter that was communicated or required to be communicated to the audit committee and that: (1) relates to accounts or disclosures that are material to the financial statements and (2) involved especially challenging, subjective, or complex auditor judgment.” The standard goes on to describe a number of factors to consider when determining whether a matter involved especially challenging, subjective or complex auditor judgment, such as the risks of material misstatement, degree of auditor judgment involved in the application of significant estimation by management, the nature and timing of a significant unusual transaction, degree of auditor subjectivity in applying audit procedures, extent of specialized skills or knowledge required to come to a conclusion, and the nature of audit evidence obtained regarding the matter.

If communication of a critical audit matter is deemed necessary, such communication should include identification of the matter, general description of the matter, description of how the matter was addressed or conclusions reached, and a reference to the relevant financial statement line items or disclosures. AS 3101 provides a flow chart (below) which summarizes the process involved in evaluating a critical audit matter.

In an effort to increase transparency and enhance the financial statement user’s understanding of the auditor’s role, several other changes were made to the auditor’s report under the new PCAOB standards. These changes include communication of auditor tenure on the engagement, an affirmative statement regarding the requirement of auditor independence, enhancements to certain standardized language, and a modified report format.

[Marcum LLP’s Assurance Services division provides independent audit, attestation and transaction advisory services to both publicly traded and privately owned companies in a wide variety of industries. Learn More.]

Enhancements to certain standardized language includes adding the phrase ”whether due to error or fraud” when describing the auditor’s responsibility under PCAOB standards. The modified report format includes section headers as well as movement of the opinion to the first section of the letter.

The standard applies to all audits conducted under PCAOB standards. However, communication of critical audit matters is not required for audits of broker-dealers, investment companies other than business development companies, benefit plans, and emerging growth companies. With the exception of provisions related to critical audit matters, the new standard takes effect for audits of fiscal years ending on or subsequent to December 15, 2017. For provisions related to critical audit matters, the new standard will take effect for fiscal periods ending on or after June 30, 2019 for large accelerated filers and December 15, 2020 for all other public entities.

Click here to read the full standard.

SOURCE

https://pcaobus.org/Rulemaking/Docket034/2017-001-auditors-report-final-rule.pdf