Federal Funding Trends

Federal grant funds are a significant source of support for domestic nonprofit organizations. However, the privilege of receiving federal funding comes with accountability. Currently, organizations that receive federal funding in excess of $750,000 per year are required to undergo a single audit which tests three areas, resulting in three audit opinions: financial statements, internal controls, and compliance.

Even if an organization does not meet the $750,000 single audit threshold, the act of receiving federal funding in any amount obligates the organization to comply with Title 2 U.S. Code of Federal Regulations (CFR) Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards, more commonly known as the “Uniform Guidance.” Uniform Guidance is a government-wide framework used for grant management. It contains administrative requirements, cost principles and audit requirements for federal awards. Most importantly, it defines minimum compliance requirements for domestic nonprofit entities receiving federal funding.

In the five years since Uniform Guidance was established, nonprofit organizations that receive federal funding have been working to institute or update their internal policies to ensure they are in compliance. The costs incurred in meeting the new compliance requirements have been substantial, but our experience tells us that the costs of noncompliance can be staggering. Not only is there a cost associated with unraveling and documenting transactions and activities after the fact, there is also a very good possibility that undocumented funds and activities will require a refund to the funding agency. Our experience with the costs of non-compliance are purely anecdotal, but what is actually happening at a macro level? This article examines data available on federal grant funding and single audits to evaluate those trends.

Single Audits

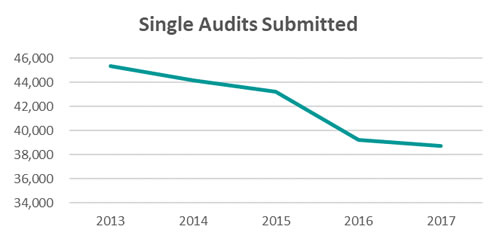

Between 2013 and 2017, the number of organizations receiving federal funding that submitted to a single audit declined by 15%.

Source: Federal Grants Clearinghouse

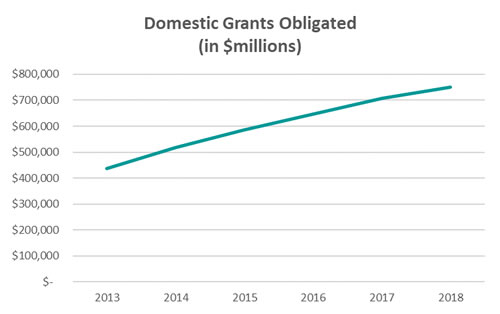

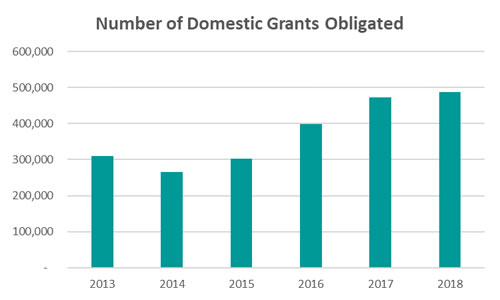

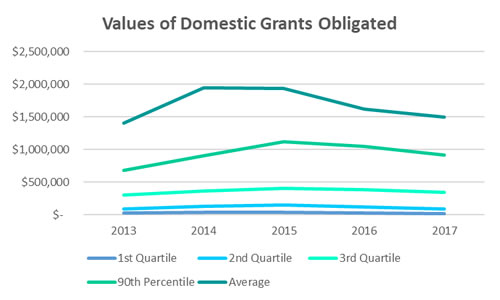

While the federal dollars obligated (amounts agreed upon by federal agencies) and the total number of grants have increased, the dollar value of 75% of those obligations is less than $350K over the last five years.

Source: USAspending.gov

Source: USAspending.gov

Source: USAspending.gov

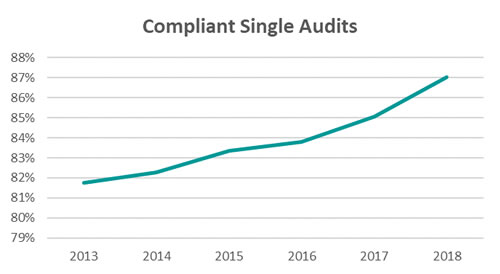

The good news is that, for those organizations that submit their single audits to the Federal Audit Clearinghouse, compliance is on the rise. The theory is those organizations that expend the resources to ensure compliance are more likely to apply for and receive federal grant funding.

Source: Federal Grants Clearinghouse

While 2018 is not yet complete, there is a statistically significant sample of submissions

Federal Grants Compliance: What is the Problem?

While compliance is generally up, there are persistent issues in compliance. The table below includes the universe of non-compliant single audits and the type of finding as a percentage of total single audits, as highlighted:

Single Audit Compliance Findings

| Type | Title | 2017 | 2018 |

|---|---|---|---|

| A | Activities allowed/unallowed | 5% | 4% |

| B | Unallowable costs/cost principles | 15% | 13% |

| C | Cash management | 11% | 10% |

| D | Reserved | 0% | 0% |

| E | Eligibilty | 18% | 18% |

| F | Equipment and real property management | 4% | 4% |

| G | Matching, level of effort, earmarking | 4% | 4% |

| H | Period of performance | 2% | 2% |

| I | Procurement, suspension and debarrment | 12% | 15% |

| J | Program income | 2% | 2% |

| K | Reserved | 0% | 0% |

| L | Reporting | 28% | 26% |

| M | Subrecipient monitoring | 6% | 5% |

| N | Special tests and provisions | 32% | 36% |

| P | Other | 22% | 21% |

Source: Federal Grants Clearinghouse

While 2018 is not yet complete, there is a statistically significant sample of submissions

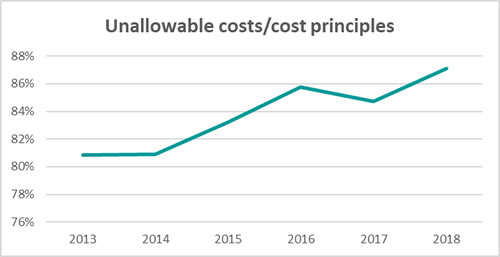

Allowable Costs/Cost Principles: Identifies cost accounting requirements associated with federal awards.

Source: Federal Grants Clearinghouse

While 2018 is not yet complete, there is a statistically significant sample of submissions

- There is continued improvement in compliance; however, compliance levels are still not at an acceptable level.

- Findings in this area are generally related to costs being properly documented and identified as allowable program costs, such as the following:

- Payroll allocations are based on an estimate rather than actual.

- Time related to program payroll is not contemporaneously documented.

- Time related to program payroll is not reviewed and properly approved.

- Program expenses are not reviewed and approved by grant manager.

- Indirect costs include unallowable costs.

- Indirect rate is misapplied.

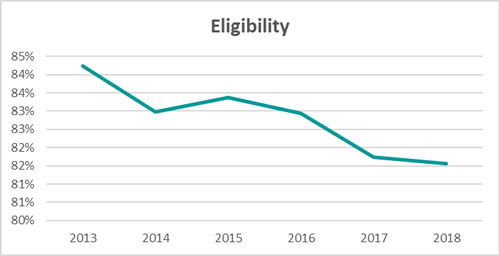

Eligibility: Specifies the criteria for determining the individuals, groups of individuals, or sub-recipients who can participate in the program and the amounts of assistance for which they qualify. This compliance requirement does not refer to the eligibility of the primary recipient.

Source: Federal Grants Clearinghouse

While 2018 is not yet complete, there is a statistically significant sample of submissions

- Compliance in this area is trending downward, though it is difficult to ascertain the reasons why.

- Findings in this compliance area are related to the documentation and process for identifying eligible participants, such as:

- Program participants did not meet the maximum age/income/geographic threshold.

- There does not exist a process for identifying eligible participants.

- There exists a process, but it is not executed or documented.

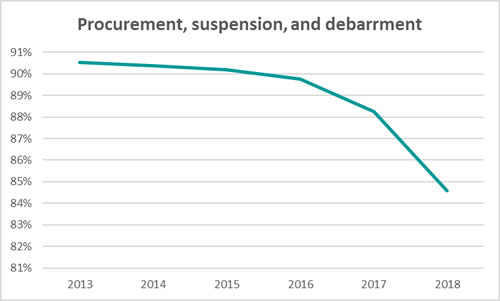

Procurement, Suspension, and Debarment:

- Procurement – Non-federal entities other than states, including those operating federal programs as sub-recipients of states, must follow the Uniform Guidance procurement standards.

- Suspension & Debarment – Non-federal entities are prohibited from contracting with or making sub-awards with parties that are suspended or debarred.

Source: Federal Grants Clearinghouse

While 2018 is not yet complete, there is a statistically significant sample of submissions

- For the first year of implementation, the decline in compliance for procurement, suspension and debarment is not a surprise. There have been multiple revisions, delays in implementation, and much conversation about this compliance requirement.

- Findings in this compliance area relate to having written procurement policies, competition, and documentation of the process, such as:

- A procurement policy exists, but the organization does not enforce it.

- The organization has appropriate procedures, but did not update its policy.

- The organization did not have support that a vendor was checked for suspension and debarment.

- Some organizations establish policies that are more restrictive than they need to be. For example, one entity required all procurement, not just covered transactions, to be subject to the procurement process as required under Uniform Guidance. This meant that the organization was out of compliance when they did not require a sealed bidding process for their information systems consulting, or for their annual meeting space at a hotel, where they had held the annual meeting for the last 15 years. Clearly, the organization intended to exceed the expectations of their oversight agency, but they overshot their capacity to comply, and ended up with single audit findings.

Reporting: Grant recipients are required to use standard financial reporting forms for submitting information to the federal awarding agency, and performance or special reports are also required.

Source: Federal Grants Clearinghouse

While 2018 is not yet complete, there is a statistically significant sample of submissions

- Compliance in this area has been historically low. However, for the purposes of this article, single audits sampled to identify common reporting findings erroneously included significant deficiencies and material weaknesses in internal controls in financial reporting. Therefore, it is quite possible that compliance in this area has been historically understated.

- Findings in this compliance area relate to timely preparation, review, and submission of required financial and program reports, such as:

- Reports did not contain evidence of review or approval.

- Required reports were not filed timely.

Special Tests and Provisions and Other: These are compliance requirements that are unique to each federal program. Unfortunately, recipients overlook the award document that provides these specific compliance requirements.

Source: Federal Grants Clearinghouse

While 2018 is not yet complete, there is a statistically significant sample of submissions

- These compliance findings result from agency or individual grant requirements.

- Findings in these compliance areas vary and depend on the program, and most are because the recipient organization did not review the grant document for these requirements. Examples of such findings are as follows:

- Lack of appropriate review and supervision for mental health provider.

- Reserve accounts are not properly funded for housing entity.

- Application of appropriate sliding fees charged for patients of a health clinic.

Summary

Some organizations have dropped the federal government as a funding source for either cost/benefit or political reasons. Organizations that continue to receive federal funding can avoid most compliance findings with strong internal controls, proficient and skilled accounting staff, competent grant supervision and oversight, and continued federal grants accountability training for all levels of organization staff. Organizations should also undergo a practical review of policies and procedures on an annual basis, to evaluate for efficiency, effectiveness, and compliance.